Many Companies Have Cyclical Operating Cash Needs Due to:

Delays in customer payments C. In spite of this cyclicality they have been able to steadily increase their dividends for over 25 consecutive years in order to make.

The Meaning Of A Cyclical Industry Explained For Beginners With Examples

OA Mergers and acquisitions В.

. Many companies have cyclical operating cash needs due to-Mergers and acquisitions-The seasonality of sales-Delays in customer payments-Refinancing of deb. OBThe seasonality of sales OCDelays in customer payments DRefinancing of debt OENone of the above requires cyclical operating cash QUESTION 23 Expected credit loss is calculated as. A company that finds itself unable to do so because unfavorable market conditions reduce its operating cash flows will see its share price suffer almost as much as if.

Demand for Credit Operating activities Cyclical operating cash needs such as materials or labor Advance seasonal purchases Investing activities Large amounts of cash for investments such as new equipment or mergers Long-term debt routinely used for start-up and growth Financing activities Occurs less frequent than. View Test Prep - Module 4 Answers from FIN 335 at Rhode Island College. Why do lenders distinguish between Many companies have cyclical operating cash needs.

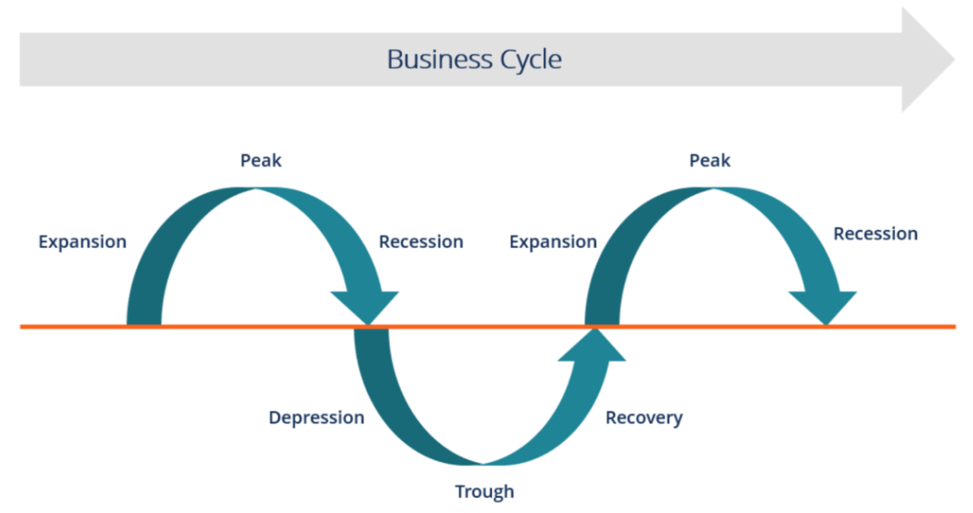

Investors should recognize moreover that companies in cyclical industries like manufacturing have to keep cash. Competent management teams of best-of-breed cyclical companies understand the need to be conservative with their finances. Having established the ongoing discipline of a budget balanced on cash the ebb and flow of cyclical operating cash needs throughout the fiscal year will invariably remain due to the nature and rhythm of a ballet companys.

Using this framework we will develop two ways of adapting discounted cash flow valuations for cyclical and commodity companies. Mergers and acquisitions C. All of the other companies is around 49.

Second many of the best-of-breed cyclical stocks have conservative financial structures. The most experienced management teams of cyclical companies are keenly aware that a future down cycle is inevitable. _ HME Modute 4.

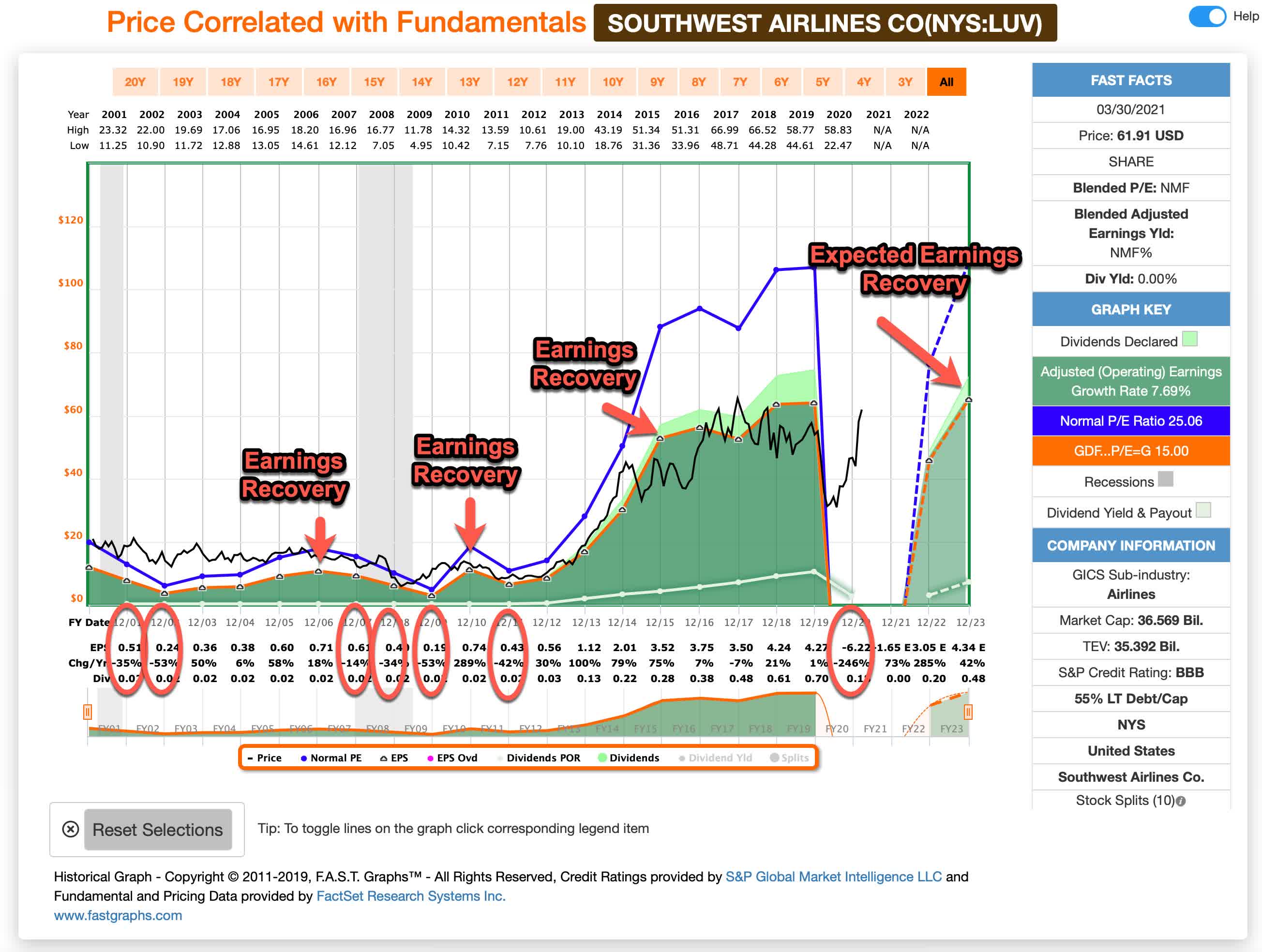

Delays in customer payments D. For operating cash flow I apply a normal price to operating cash. However there are many Dividend Aristocrats and Dividend Champions that are in fact cyclical companies.

The main purpose for credit risk. A Mergers and acquisitions B The seasonality of sales C Delays in customer payments D Refinancing of debt Correct answer. Many companies have cyclical operating cash needs due to.

The most experienced management teams of cyclical companies are keenly aware that a future down cycle is inevitable. None of the above QUESTION 22 Many companies have cyclical operating cash needs due to. This happens in the ordinary course of business.

Capital-intensive firms have a much harder time maintaining cash reserves. Because these purchases are made long before expected sales suppliers. Companies often borrow money to fund operating activities.

Competent management teams of best-of-breed cyclical companies understand the need to be conservative with their finances. This has resulted in negative cash flow from operating activities. Identifying the intrinsic value of a cyclical stock is more difficult than valuing a company with a steady history of growing earnings.

Rapidly growing companies often have negative cash flow precisely because working capital. View the full answer. The seasonality of sales B.

The seasonality of sales. Many companies have cyclical operating cash needs due to. Mergers and acquisitions D.

For instance a company that has a. Credit Risk Anaiysis and interpretatSOn - Wfime Chaicafv 1 Many companies have cyclical. Competent management teams of best-of-breed cyclical companies understand the need to be conservative with their finances.

Companies in highly cyclical industries with weak balance sheets and large capital spending programs should carry more cash than those in stable sectors with strong balance sheets and limited capital needs Cash also gives these companies the flexibility to make acquisitions or other investments during periods of market turmoil he. Lenders distinguish between cyclical cash needs and cash needed to fund operating losses because the second type of cash is riskier. Second many of the best-of-breed cyclical stocks have conservative financial structures.

Many companies do not have stable or predictable revenue throughout the year. The simplest way to view cash flow is to define it as the difference in the cash balances of a company on two dates. In the first we will normalize our estimates for all four of these inputs using normalized cash flows growth rates and discount rates to estimate a normalized value for a firm.

It is typical for firms such as retailers to experience cyclical cash lows during the year as they gear up for busy season October December for many retailers. For example companies that manufacture in This is also the case for retailers that purchase merchandise for the end-of-year holiday season. Previous question Next question.

In order to have an endowment equal to at least the size of our. Many companies have cyclical operating cash needs due to-Mergers and acquisitions-The seasonality of sales-Delays in customer payments-Refinancing of deb. Refinancing of debt B.

Chance of default X Total Debt В. Many companies have cyclical operating cash needs due to 3pts. Manufacturing companies for example may have cyclical sales that.

Capital Finance Addresses Cyclical Or Seasonal Capital Needs Of Businesses In Fact It Builds Up Short Term Business Loans Capital Finance Commercial Lending

Business Essentials Managing Rapid Business Growth Business Growth Small Business Advice Business Essentials

Earning Cash Is One Thing However The Investment And Conserving Of Cash Is An Entirely Different Ball Game Click Her Invest Wisely Investing Investing Money

In Our Previous Insight We Took A Look At Haidilao S Background Information Haidilao Is A Leading Premium H Global Recipes Background Information Group Meals

Cyclical Vs Non Cyclical Industries 365 Financial Analyst

Cyclical Stocks List Of Sectors And Investing Example

Open Office Spreadsheet Templates Spreadsheet Template Spreadsheet Checklist Template

Regions Bank Statement Template Regions Bank Personal Financial Statement Forms Statement Template Personal Financial Statement Bank Statement

/dotdash_Final_Cyclical_vs_Non-Cyclical_Stocks_Whats_the_Difference_Nov_2020-012-2b96cee86d4a4aa994415b25164a24f8.jpg)

Understanding Cyclical Vs Non Cyclical Stocks What S The Difference

A 2021 Buying Guide For Cyclical Stocks Including 3 Current Ideas Seeking Alpha

/dotdash_Final_Cyclical_vs_Non-Cyclical_Stocks_Whats_the_Difference_Nov_2020-012-2b96cee86d4a4aa994415b25164a24f8.jpg)

Understanding Cyclical Vs Non Cyclical Stocks What S The Difference

Cyclical Vs Non Cyclical Industries 365 Financial Analyst

Market Value Of Equity What Is Marketing Financial Strategies Equity

Your Guide To Understanding Cyclical Stocks

The Meaning Of A Cyclical Industry Explained For Beginners With Examples

Pin By Hisham Hambal On Economics Policy Word Search Puzzle Words Economics

Accountant At Agriwave Group September 2021 Job Opportunities Accounting Interpersonal Skills

Comments

Post a Comment